So many people I talk with are saying they think home prices are going drop. Every area is different but in the Minneapolis St Paul area, homes seem to be going very quickly! It does depend on the home, location and sales price. Others are concerned about interest rates and are waiting for rates to drop. From the charts I have seen, you are better off buying now and refinancing in a year or two when rates do drop.

Think Twice Before Waiting for Lower Home Prices

As the housing market continues to change, you may be wondering where it’ll go from here. One factor you’re probably thinking about is home prices, which have come down a bit since they peaked last June. And you’ve likely heard something in the news or on social media about a price crash on the horizon. As a result, you may be holding off on buying a home until prices drop significantly. But that’s not the best strategy.

A recent survey from Zonda shows 53% of millennials are still renting right now because they’re waiting for home prices to come down. But here’s the thing: the most recent data shows that home prices appear to have bottomed out and are now on the rise again. Selma Hepp, Chief Economist at CoreLogic, reports:

“U.S. home prices rose by 0.8% in February . . . indicating that prices in most markets have already bottomed out.”

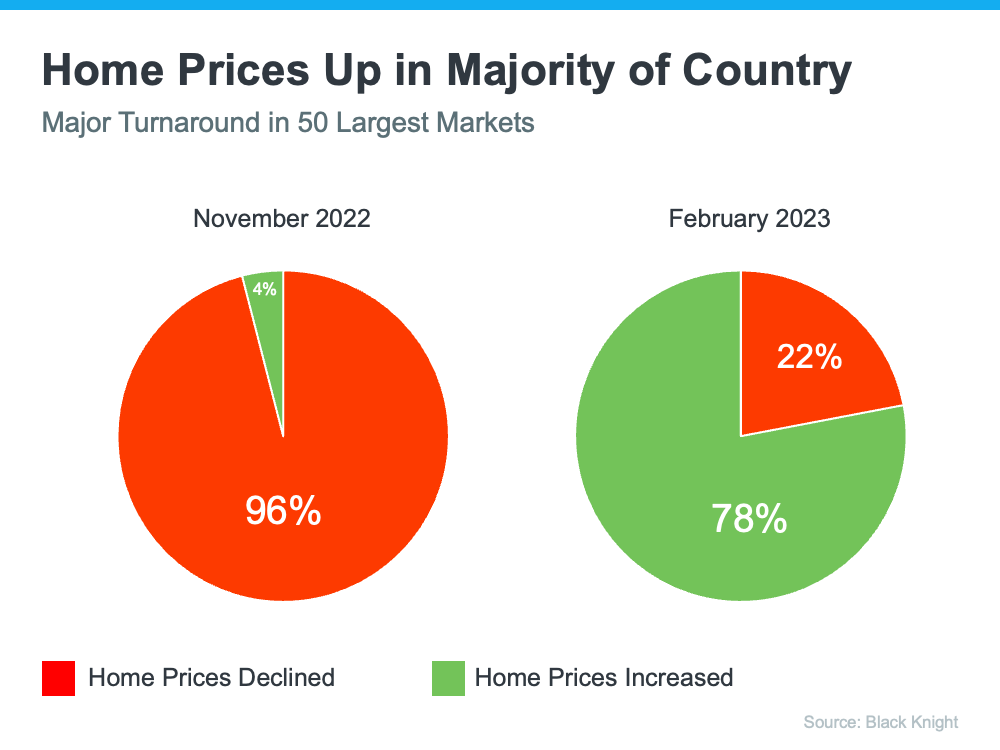

And the latest data from Black Knight shows the same shift. The graph below compares home price trends in November to those in February:

So, should you keep waiting to buy a home until prices come down? If you factor in what the experts are saying, you probably shouldn’t. The data shows prices are increasing in much of the country, not decreasing. And the latest data from the Home Price Expectation Survey indicates that experts project home prices will rise steadily and return to more normal levels of appreciation after 2023. The best way to understand what home values are doing in your area is to work with a local real estate professional who can give you the latest insights and expert advice.

Bottom Line

If you’re waiting to buy a home until prices come down, you may want to reconsider. Let’s connect to make sure you understand what’s happening in our local housing market.

We can show you how the numbers can affect your home costs based on what we expect to happen with home prices and interest rates. No one really knows for sure what will happen in the future, we are all using the best information we have to help you with your home buying process.

This post is from our blog at Keeping Current Matters.

Leslie Vanderwerf, NMLS ID#335509, CrossCountry Mortgage LLC, An Equal Housing Lender, NMLS#3029 – Email – Website