When people learn I am a Realtor I get asked not only about how the market is doing, but also about whether it is getting easier to get a mortgage. I thought this recent post from Keeping Current Matters would be good to share.

There has been a lot of talk about how difficult it is to get a home mortgage in today’s lending environment. However, three recent reports have revealed that lending standards are beginning to ease. This is great news for both first time buyers and current homeowners looking to move or buy a second vacation/retirement home. Let’s look at the three reports:

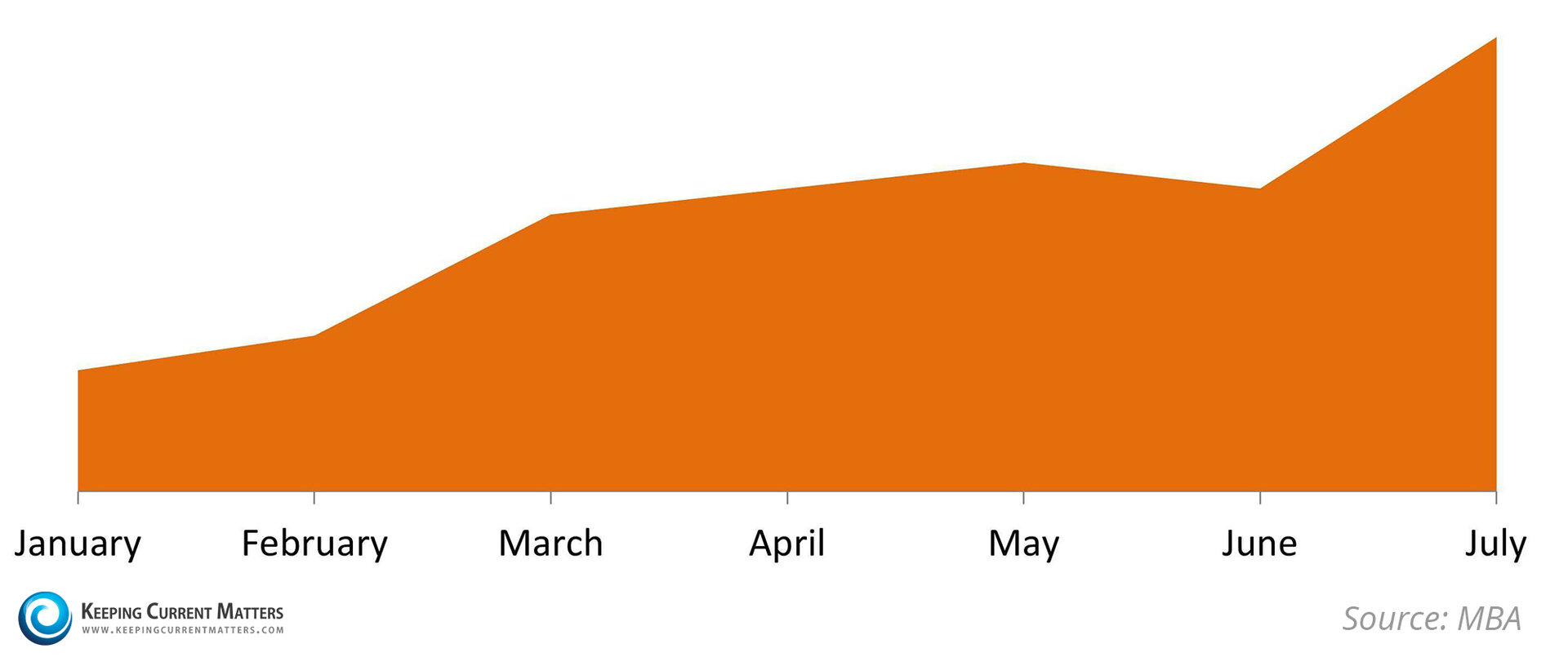

The MBA’s Mortgage Credit Availability Index

This index, issued by the Mortgage Bankers’ Association, measures the availability of credit available in the home mortgage market. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of a loosening of credit. We can see that the index has been increasing nicely this year:

Fannie Mae’s latest Mortgage Lender Sentiment Survey

This survey revealed that more lenders report that mortgage lending standards across all loan types are easing. The survey asked senior mortgage executives whether their company’s credit standards have eased, tightened, or remained essentially unchanged during the prior three months. The gap between lenders reporting easing as opposed to tightening over the prior three months jumped to approximately 20%. This represented a new survey high of "net easing." In addition, the share of lenders who expect their organizations to ease credit standards over the next three months also ticked up this quarter.

Doug Duncan, senior vice president and chief economist at Fannie Mae, addressed this easing of standards:

"For the first time in seven quarters, we see a pronounced increase in the share of lenders, particularly medium- and larger-sized lenders, reporting on net an easing of credit standards … This is a significant result in light of public discourse on credit availability and standards … Overall, we expect that lenders' tendency toward easing credit standards, together with relatively low mortgage rates and a strengthening labor market, will continue to support the housing market expansion."

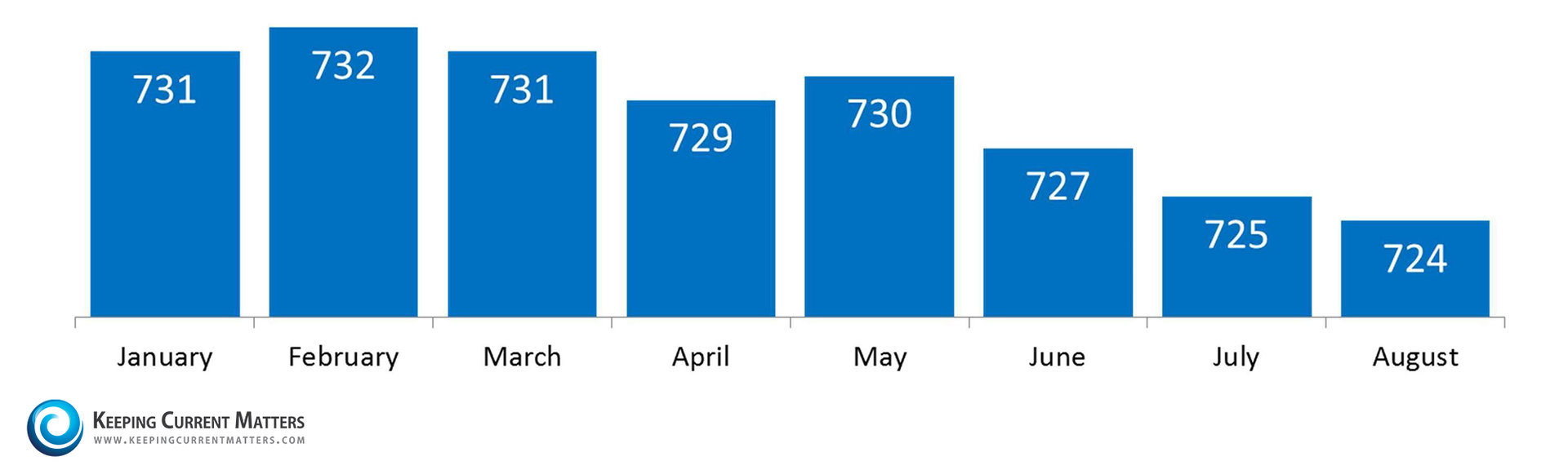

Ellie Mae’s latest Origination Insights Report

The easing of credit standards is also confirmed in this report which showed that the average FICO score on a closed loan fell to its lowest point in well over a year. Here is a chart of average FICO scores on closed loans so far in 2015:

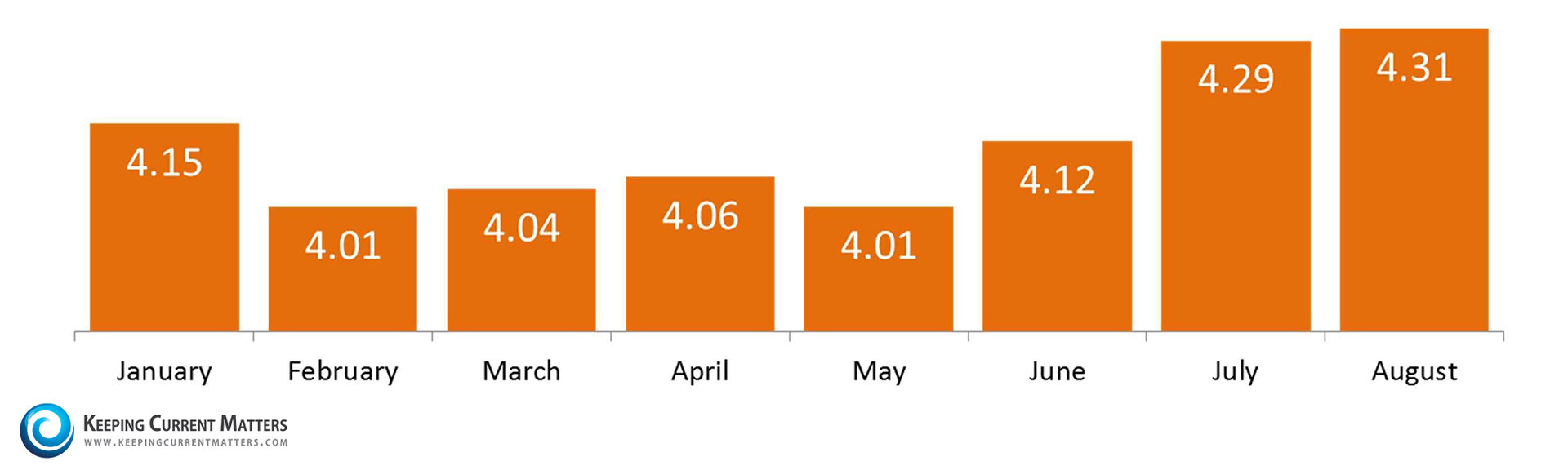

Just keep an eye on interest rates…

Although this is all great news, there was one challenge in the recently released data. Ellie Mae reported that the average interest rate on closed loans is beginning to inch upward:

What this means to you…

If you are a first time buyer or a current homeowner thinking of moving up to a bigger home or buying a vacation home, now may be the time to act. Mortgage lending standards are beginning to ease and interest rates are beginning to inch up.

The team at HomesMSP - Sharlene, John, Angela – Minneapolis-St. Paul Realtors